The Cost Accumulation Model Assigns Costs Through Each Phase of the Production Process

What you'll learn to do: Examine the process cost accounting system

There are some similarities and differences between job-order costing and process costing. Both are common costing methods for companies. We will look at the differences between the two methods, when process costing is used, and how costs flow through the system. We will also examine how process costs are recorded in the accounting system.

Learning Outcomes

- Compare and contrast job order and process costing

- Explain the flow of costs in a process costing system

- Calculate equivalent units of production and cost per equivalent unit using the weighted average and FIFO methods

- Prepare sample cost reconciliation journals for both the weighted average and FIFO methods

- Discuss how to allocate service costs as operations costs using the direct and step-down methods

Job Order Costing vs Process Costing

You have just been hired as an accountant at a local manufacturing company. They are a small start-up and are unsure how to enter costs into their accounting system. Having just purchased Quickbooks software, it is time to decide how they get it set up to work most effectively for their needs. Currently, the company makes one product, the Ultimate Planner. The Ultimate Planner is a printed planner designed to make every small business owner's life just a bit easier. Sales have been great, but they are now in a position to really get down to ensure that they are making money on each planner they sell.

You sit down and take a look at the two possible costing methods; Job order costing and process costing. Let's first compare the two:

| Job Order Costing | Process Costing |

|---|---|

|

|

Let's think about our product. We produce, one thing on acontinuous basis: the planner. If you look at the two types of costing, which one makes more sense?

Both of the systems are alike in that they are designed to accumulate costs such as materials, labor and manufacturing overhead, and assign them to a product. We will also be using the same accounts, regardless of which costing method we use. So remember from our previous unit, we will use:

- Manufacturing overhead

- Raw materials

- Work in process (WIP)

- Finished goods

The costs will also flow through the system in a similar way. But what are the differences?

In the process costing, we are making one product either all the time or for an extended period of time. So in the case of our Ultimate Planner, since we make one product, it seems to make more sense to use process costing, right?

What would happen, if down the line, they decide to do special custom planners for different customers? For example, an order comes in to make a planner in a certain color for a large employer to give to all employees. This may create a "job-order costing" situation, rather than a "process costing" situation. But for right now, they are only creating one product in their facility and they are producing it all the time—let's move forward with process costing.

Practice Questions

Flow of Costs (Process Costing)

The flow of costs in the process costing system is similar to in a job-costing system, but let's review with our Ultimate Planner example:

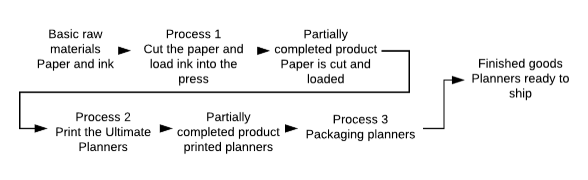

In the process planning we will cost by process. Process 1 involved preparing the raw materials for printing, process 2 is the actual printing, and process 3 is packaging the planners to be moved to finished goods inventory. Costing is simpler in this system because rather than having to prepare a costing sheet for many products, we only need to do costing for three departments or processes.

We start with the basic inputs:

- Raw materials

- Wages

- Manufacturing overhead

Manufacturing overhead will be estimated, just as in the job costing method, but will need to be recorded as incurred. The clearing account will be used to accumulate the actual costs, and a reconciliation will be done at the end of each period.

A processing department is a unit where work is performed on a product and where materials, labor or overhead are added to the product. In the case of our planner, we first add the raw materials, then we add labor to process the raw materials, next conclude with additional labor to package the finished product to prepare it for shipment. These will be the three processes used for costing. Each business will have different processing departments, depending on the product they are making.

Each of these processing departments will be a work-in-process center. So a job costing system may have only one work-in-process, while a process costing system will have several. In the Ultimate Planner example, there will be three WIP accounts.

Raw materials, labor and overhead can be added during any process. So the costs in Process 2 will include everything happening in that process, plus the costs that are attached to the partially completed product transferred in from Process 1. These are called transferred-in costs.

Practice Questions

Equivalent Unit Calculations

So the Ultimate Planner goes through three departments on its way to finished goods inventory. In each department raw materials, labor and overhead are being added to the planners. In order to calculate a product unit cost, those costs need to be accumulated, as the planner isn't finished. Each department has an ending inventory of unfinished planners. How can we figure out the costs at each stage of production? The easiest way is to figure out what percentage of the planner is completed, as to the work in that department. We call this the equivalent units of production method of costing:

equivalent units = number of partially completed units × Percentage completed

At the end of process 1, our planners have their paper and ink ready to be printed. Let's assume we figure the ending WIP inventory to be 35% complete as to the process. If we have 1000 units in the ending WIP inventory after process 1, this would equal 350, using the formula for equivalent units. We could then add these equivalent units to the ending WIP inventory for process 1. Any units that have been moved into process 2, will be subtracted from the WIP inventory for process 1.

There are two ways we can calculate the equivalent units of production for a department or process: weighted-average or FIFO (first in, first out).

Weighted Average

In this method we use the following equation:

[latex]\begin{array}{rr}&\text{Units transferred to the next department or to finished goods}\\+&\text{Equivalent units in ending work in process inventory}\\&\hline\\&\text{Equivalent units of production}\end{array}[/latex]

One thing to keep in mind when using the weighted average method, we don't need to compute the equivalent units for the ones transferred out. Those are considered 100% complete for the work done in that department, otherwise they wouldn't be moving forward to the next process.

Example

In the current period, we transferred 500 units to process 2, and have 350 equivalent units in our WIP inventory. So our equivalent units of production for the period would be 850 units. Essentially saying, that process 1 completed 850 units to completion of process 1 in this period.

Example

700 units were transferred from process 1 to process 2. We also have 1000 partially completed units that are 50% complete.

We would have 500 equivalent units in our WIP inventory. (1000 × 50%) + 700 units that were transferred out. Our equivalent units of production for the period is 1,200 units (700 + 500).

FIFO

Equivalent units can also be calculated using the FIFO method. In this method, the units that have been moved to the next process are divided into two parts:

- The units that were in beginning inventory and completed

- The units that were both started and finished in the current period.

In this method, both the beginning and ending inventory is converted into equivalent units, so there is a bit more work to do. For those units that were in the beginning inventory, we need to figure out how much work was DONE on them in this period to get them to the point of being transferred to the next process. For those items in the ending inventory, it is the same as the weighted-average method, where we need to calculate how much work has been done to them already.

Example

We have 500 units in our beginning inventory that needed 50% more done to them yet = 250 units

We also completed 500 units that were started and finished in this period = 500 units

And we have 1000 units that are 25% complete at the end of the period = 250 units

So how many units did we complete during the period? 250 + 500 +250 = 1000 units were completed through process 1 for the period.

In our next section, we will do a comparison and reconciliation of the same number of products through one process with each of the two methods.

Practice Questions

Cost Reconciliation

The costs per equivalent unit are used to value the units in the ending inventory and the ones that have been moved to the next process. When calculating the equivalent units with the weighted average method and the FIFO method we will end up with a different quantity, using the same data.

Let's first look at the equivalent units of production using the weighted average method.

| The Ultimate Planner: Weighted Average Method | ||

|---|---|---|

| Qty | % Complete | |

| Beginning WIP Inventory | 500 | 30% |

| Units started and completed | 4300 | 100% |

| Units started and NOT completed | 500 | 25% |

| Units completed and moved to process 2 | 4800 | |

| Ending WIP x% complete | 125 | |

| Equivalent units of production | 4925 | |

Now, let's look at the same information using the FIFO method:

| The Ultimate Planner: FIFO Method | ||

|---|---|---|

| Qty | % Complete | |

| Beginning WIP Inventory | 500 | 30% |

| Units started and completed | 4300 | 100% |

| Units started and NOT completed | 500 | 25% |

| Beginning WIP 500x 70% yet to complete | 350 | |

| Units completed and moved to process 2 | 4300 | |

| Ending WIP x % complete | 125 | |

| Equivalent Units of Production | 4775 | |

Remember, in the weighted average method, we add the beginning WIP and the product started and finished in the period, adding the units started, but not completed based on the percentage completed.

With the FIFO method, we need to adjust the beginning WIP by the amount that was needed to complete yet to get that beginning WIP finished and moved on.

Figuring the costs per unit is our next task. Now that we have figured out how many equivalent units of production via each method, let's apply the costs. Costs consist of raw materials, direct labor and overhead for each item produced. Sometimes, a great deal of the raw materials have already been put into a product, but it still needs a chunk of labor to move it to the next department. In this case, we may have a different percentage of completion for the raw materials and the conversion costs. Conversion costs are defined as direct labor plus manufacturing costs needed to finish a product.

Note: For the purposes of this course, we will assume one percentage of completion that is both the materials and conversion costs. Just a reminder, that these may be different in a real world application.

So let's look at a cost computation using the two methods:

Using the Weighted Average Method

Cost per equivalent unit = Cost of beginning WIP inventory + Cost added during the period

Equivalent units of production

So from our example above, we have 4925 equivalent units of production using the weighted average method. If our total cost of our beginning WIP inventory was $1,000 and we added $10,000 during the period.

$1,000 + $10,000 = $2.2335/ unit

4925 units

A reconciliation of the initial costs, plus costs added using the weighted average method:

| Costs to be accounted for: | |

|---|---|

| Cost of beginning WIP inventory | $1,000 |

| Costs added during the period | $10,000 |

| Total costs to be accounted for | $11,000 |

| Costs accounted for: | |

| Cost of ending WIP inventory | $279 |

| Cost of units transferred out | $10,721 |

| Total cost accounted for | $11,000 |

Using the FIFO Method

We only use the costs incurred during the current period. So in our example, we incurred $10,000 in the current period and our equivalent units of production from our example above is 4775, so

$10,000 = $2.0942/ unit

4775 units

So to reconcile the costs using the FIFO method:

| Costs to be accounted for: | |

|---|---|

| Cost of beginning WIP inventory | $1,000 |

| Costs added during the period | $10,000 |

| Total costs to be accounted for | $11,000 |

| Costs accounted for: | |

| Cost of ending WIP inventory | $262 |

| Cost of units transferred out | $10,738 |

| Total cost accounted for | $11,000 |

(note: you need to not round intermediate calculations to get here!)

The cost of the ending WIP inventory is 125 units × $2.0942

The cost of the units transferred out is calculated:

4800 units × $2.09 plus the $658 of costs incurred for the beginning inventory that was transferred out.

The cost of the products initially in the beginning WIP need to be added in since in the FIFO method, we had not yet accounted for those costs.

The take-away here is that either method will end up with the same costs being moved forward with the completed units to the next process. These costs will be added to additional costs as the product moves through each of the processes until it arrives in the finished goods inventory.

Practice Questions

Direct and Step-Down Methods

In process costing, all of the processing departments are classified as operating departments. Other departments, called service departments are needed for the business to operate, but do not directly engage in operating processes. Service departments include accounting, human resources and purchasing. These departments all provide services to each of the operating departments.

So with our Ultimate Planner business, the product itself is produced in the production/manufacturing department, but in order for that department to run, payroll needs to be prepared, employees need to be hired and product needs to be purchased. There are two main ways to allocate these service costs to the operating departments to make sure we are including all of the costs when we price our products.

The first method is the direct method. This is the simplest and most commonly used method of allocation.

In this method, we will be ignoring the fact that one service department may offer services to another service department. For example, the HR department will offer services to the accounting department by hiring staff and providing training. Instead, we will allocate ALL of the services of each of these departments to the operating departments.

We can allocate using a couple of different methods of allocation. Some costs may be allocated based on employee hours. Administration costs are a good example here. So the hours incurred by administrative departments such as payroll, purchasing, accounting and HR, would be allocated, based on the number of hours worked in each of the operating departments and allocated accordingly. Here, if process 1 of manufacturing our Ultimate Planner takes 5,000 hours per period, while packaging (process 3) only takes 1,000 hours per period, then allocation based on employee hours would be the most effective way to allocate service costs.

Custodial services on the other hand, may be better allocated based on the square footage of each of the operating departments. If the press area (process 1) of the Ultimate Planner business occupies 10,000 square feet, while the packaging area only occupies 2,000 square feet, it probably takes more custodial effort in the press area! So allocation on space would work best.

The second method is called the step-down method. This method is more complicated than the direct method, as it also takes into account the services that one service department offers another.

Note in this method, the human resources costs are allocated between custodial and all of the operational processes, while in the direct method, human resources and custodial are directly allocated to the operational processes.

So if the custodial department cleans the HR department, some costs from the custodial department should be allocated to the HR department, right? Also, the HR department provides services to the custodial department, by hiring and training the employees, so some of the HR costs should be allocated to the custodial department.

There are many reasons companies may use each of these allocation methods. HERE is another explanation of this concept if you would like further clarification.

Practice Questions

The Cost Accumulation Model Assigns Costs Through Each Phase of the Production Process

Source: https://courses.lumenlearning.com/wmopen-accountingformanagers/chapter/process-costing/

Post a Comment for "The Cost Accumulation Model Assigns Costs Through Each Phase of the Production Process"